Global supply chains are complex systems responsible for moving products from multiple origin

locations to various transshipment points (such as distribution centers), and finally to their

intended destinations. In supply chain management, one of the primary challenges is solving the

transportation problem, which involves determining the optimal number of units to ship across each

segment of the network. The objective is to ensure that all destination demands are met while

minimizing transportation costs.

Supply chain managers must strategically allocate resources to achieve cost-effective and efficient

distribution. However, this task is complicated by the need to balance multiple variables, including

production capacity, demand requirements, and transportation costs. Linear programming provides a

mathematical approach to solving these network flow problems, enabling the most efficient movement

of goods across the distribution network while minimizing costs and satisfying demand requirements.

The Problem

For this example I selected the following case problem from the textbook Introduction to

Management Science: Quantitative Approach:

The Darby Company manufactures and distributes meters used to measure electric power

consumption. The company started with a small production plant in El Paso and gradually

built a customer base throughout Texas. A distribution center was established in Fort Worth,

Texas, and later, as business expanded, a second distribution center was established in

Santa

Fe, New Mexico.

The El Paso plant was expanded when the company began marketing its meters in Arizona,

California, Nevada, and Utah. With the growth of the West Coast business, the Darby Company

opened a third distribution center in Las Vegas and just two years ago opened a second

production plant in San Bernardino, California.

Manufacturing costs differ between the company’s production plants. The cost of each meter

produced at the El Paso plant is $10.50. The San Bernardino plant utilizes newer and more

efficient equipment; as a result, manufacturing cost is $0.50 per meter less than at the El

Paso

plant.

Due to the company’s rapid growth, not much attention had been paid to the efficiency of its

supply chain, but Darby’s management decided that it is time to address this issue. The cost

of shipping a meter from each of the two plants to each of the three distribution centers is

shown in Table 6.10.

The quarterly production capacity is 30,000 meters at the older El Paso plant and 20,000

meters at the San Bernardinoplant. Note that no shipments are allowed from the San

Bernardino plant to the Fort Worthdistribution center.

The company serves nine customer zones from the three distribution centers. The forecast of

the number of meters needed in each customer zone for the next quarter is shownin Table

6.11.

The cost per unit of shipping from each distribution center to each customer zone is given

in Table 6.12; note that some distribution centers

cannot serve certain customer zones.

These are indicated by a dash, “—”.

In its current supply chain, demand at the Dallas, San Antonio, Wichita, and Kansas City

customer zones is satisfied by shipments from the Fort Worthdistribution center. In a

similar

manner, the Denver, Salt Lake City, and Phoenix customer zonesare served by the Santa Fe

distribution center, and the Los Angeles and San Diego customer zones are served by the Las

Vegas distribution center. To determine how many units to ship from each plant, the

quarterly

customer demand forecasts are aggregated at the distribution centers, and a transportation

model

is used to minimize the cost of shipping from the production plants to the distribution

centers.

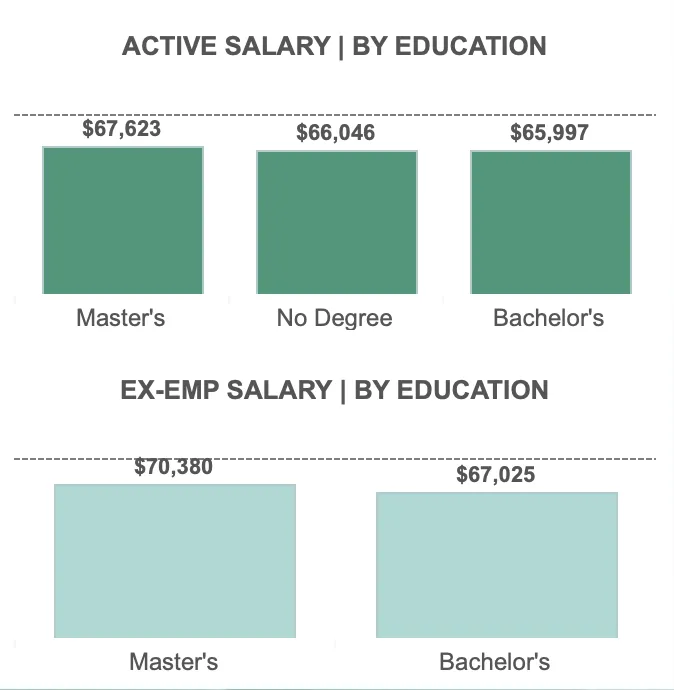

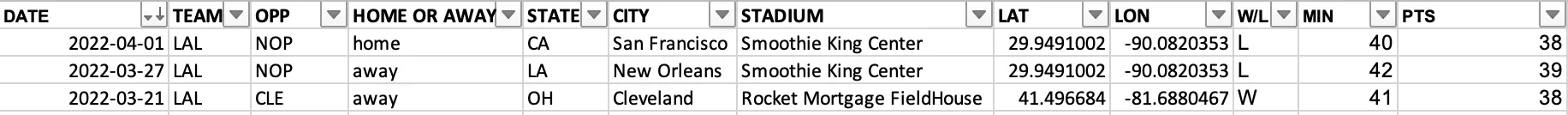

Table 6.10 SHIPPING COST PER UNIT FROM PRODUCTION PLANTS

TO DISTRIBUTION CENTERS (IN $)

|

Distribution

Center

|

|

Plant |

Fort Worth |

Santa Fe |

Las Vegas |

| El Paso |

3.20 |

2.20 |

4.20 |

| San Bernardino |

— |

3.90 |

1.20 |

Table 6.11 QUARTERLY DEMAND FORECAST

| Customer Zone |

Demand (meters) |

| Dallas |

6300 |

| San Antonio |

4880 |

| Wichita |

2130 |

| Kansas City |

1210 |

| Denver |

6120 |

| Salt Lake City |

4830 |

| Phoenix |

2750 |

| Los Angeles |

8580 |

| San Diego |

4460 |

Table 6.12 SHIPPING COST FROM THE DISTRIBUTION CENTERS

TO CUSTOMER ZONES

|

Customer

Zone

|

|

Distribution Center |

Dallas |

San Antonio |

Wichita |

Kansas City |

Denver |

Salt Lake City |

Phoenix |

Los Angeles |

San Diego |

| Fort Worth |

0.3 |

2.1 |

3.1 |

4.4 |

6.0 |

— |

— |

— |

— |

| Santa Fe |

5.2 |

5.4 |

4.5 |

6.0 |

2.7 |

4.7 |

3.4 |

3.3 |

2.7 |

| Las Vegas |

— |

— |

— |

— |

5.4 |

3.3 |

2.4 |

2.1 |

2.5 |

Managerial Report

You are asked to make recommendations for improving Darby Company's supply chain by answering

the

following questions:

- Draw a network representation of the Darby company's current supply chain map. If the

company does not change its current supply chain, what will its distribution costs be for

the following quarter?

- Suppose that the company is willing to consider dropping the distribution center

limitations; that is, customers could be served by any of the distribution centers for which

costs are available. Can costs be reduced? If so, by how much?

- The company wants to explore the possibility of satisfying some of the customer demand

directly from the production plants. In particular, the shipping cost is $0.30 per unit from

San Bernardino to Los Angeles and $0.70 from San Bernardino to San Diego. The cost for

direct shipments from El Paso to San Antonio is $3.50 per unit. Can distribution costs be

further reduced by considering these direct plant-tocustomer shipments?

Solution 1

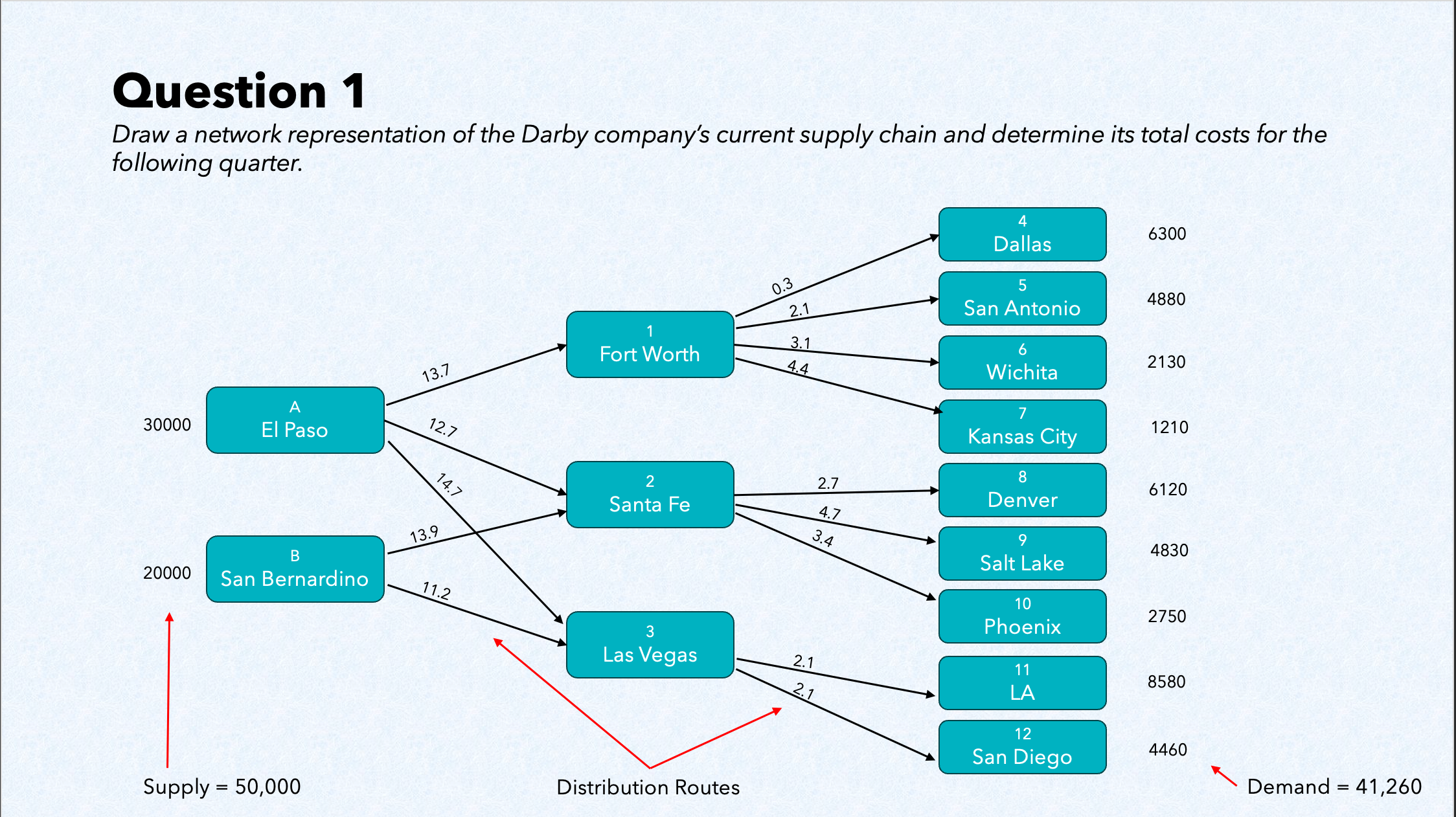

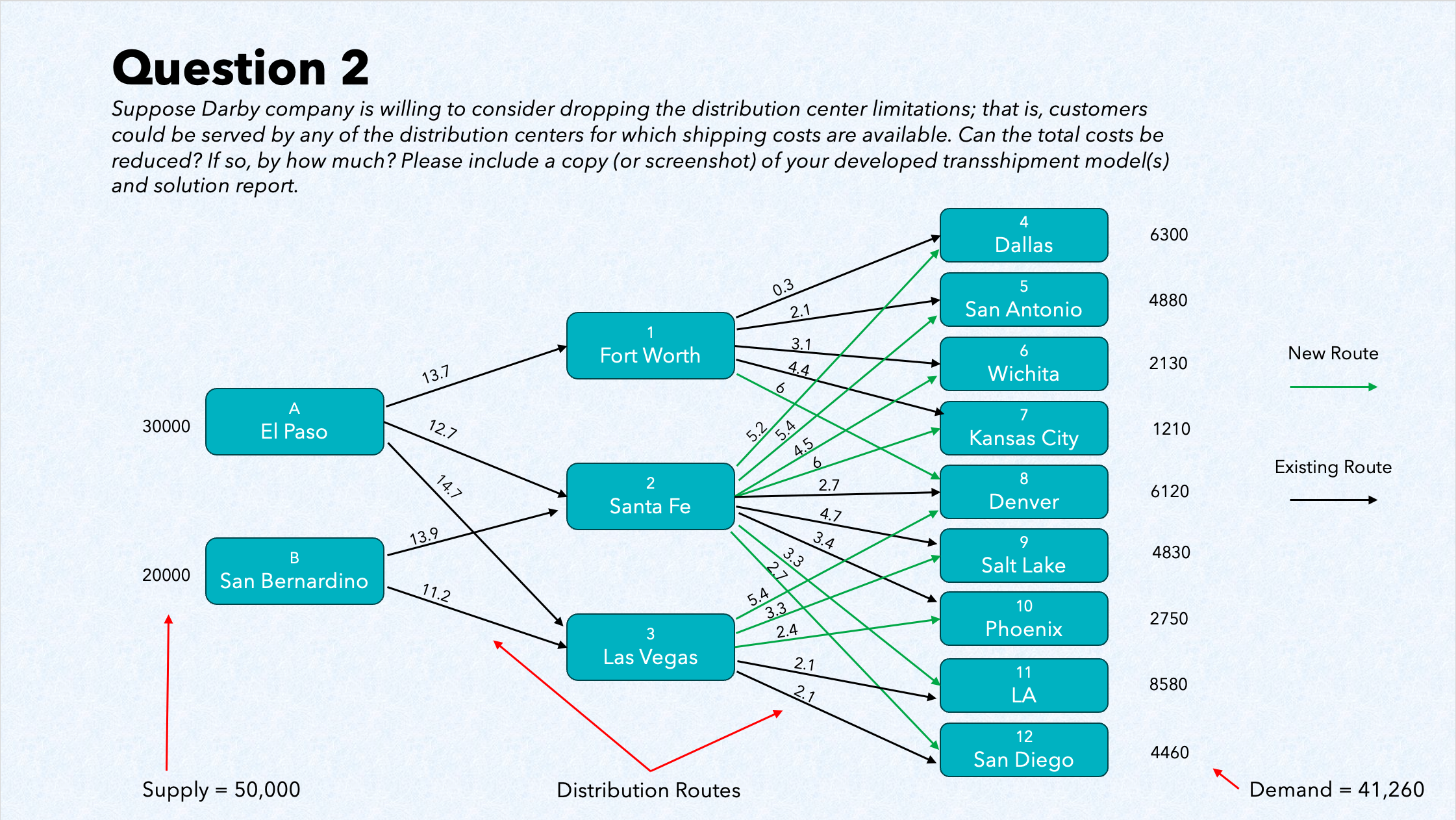

The first step is to draw a supply chain map showing all of the potential shipment arcs out of

the production plants and distribution centers under the current structure. Figure 1 shows

graphically the 14 distribution routes (arcs) Darby company can use. The ammount of supply

available is written next to each origin node, and the amount of demand is written next to each

destination node. The cost per unit of shipping from each node is written on the arc for each

route.

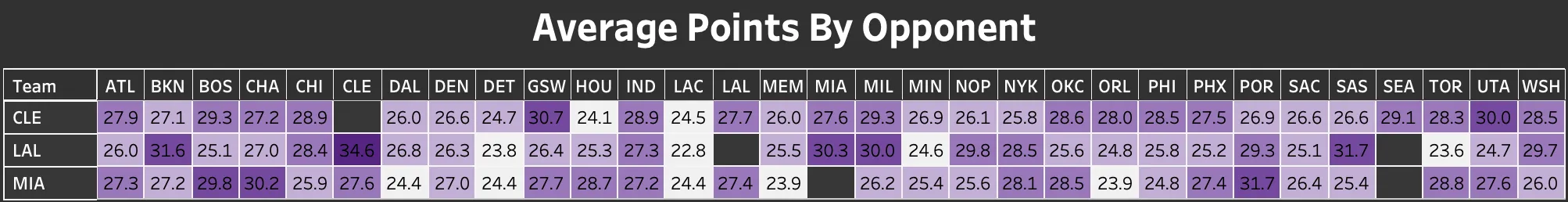

A linear programming model is used to solve this transshipment problem to determine the minimum

cost under the given constraints. I used double-subscripted decision variables based on the

labels I gave in the network diagram above, with XA1 denoting the number of units

shipped from origin A (El Paso) to destination 1 (Fort Worth), XA2 denoting the number of units

shipped from origin A (El Paso) to destination 2 (Santa Fe), and so on.

Because the objective is to minimize the total transportation cost, I used the cost data in

Table 6.12 or on the arcs in Figure 1 to develop the following objective function:

Min 13.7XA1 +

12.7XA2 +

14.7XA3 +

13.9XB2 +

11.2XB3 +

0.3X14 +

2.1X15 +

3.1X16 +

4.4X17 +

2.7X28 +

4.7X29 +

3.4X210 +

2.1X311 +

2.5X312

This objective function ensures the lowest total cost through all possible distribution routes.

Transshipment problems also require several constraints for each of the shipment nodes. For

origin nodes, the sum of the shipments out minus the sum of the shipments in must be

less than or equal to the origin supply. For destination nodes, the sum of the shipments in

minus the sum of shipments out must equal demand. For transshipment nodes, the sum of the

shipments out must equal the sum of the shipments in.

Based on the requirements listed in the problem description, I came up with the following

constraints:

El Paso supply constraint:

XA1 +

XA2 +

XA3 ≤ 30000

San Bernardino supply constraint:

XB2 ≤ 20000

Fort Worth transshipment node:

(X14 +

X15 +

X16 +

X17) -

XA1 = 0

Santa Fe transshipment node:

(X28 +

X29 +

X210) -

(XA2 +

XB2) = 0

Las Vegas transshipment node:

(X311 +

X312) -

(XA3 +

XB3) = 0

Dallas demand constraint:

X14 ≥ 6300

San Antonio demand constraint:

X15 ≥ 4880

Wichita demand constraint:

X16 ≥ 2130

Kansas City demand constraint:

X17 ≥ 1210

Denver demand constraint:

X28 ≥ 6120

Salt Lake City demand constraint:

X29 ≥ 4830

Phoenix demand constraint:

X210 ≥ 2750

Los Angeles demand constraint:

X311 ≥ 8580

San Diego demand constraint:

X312 ≥ 4460

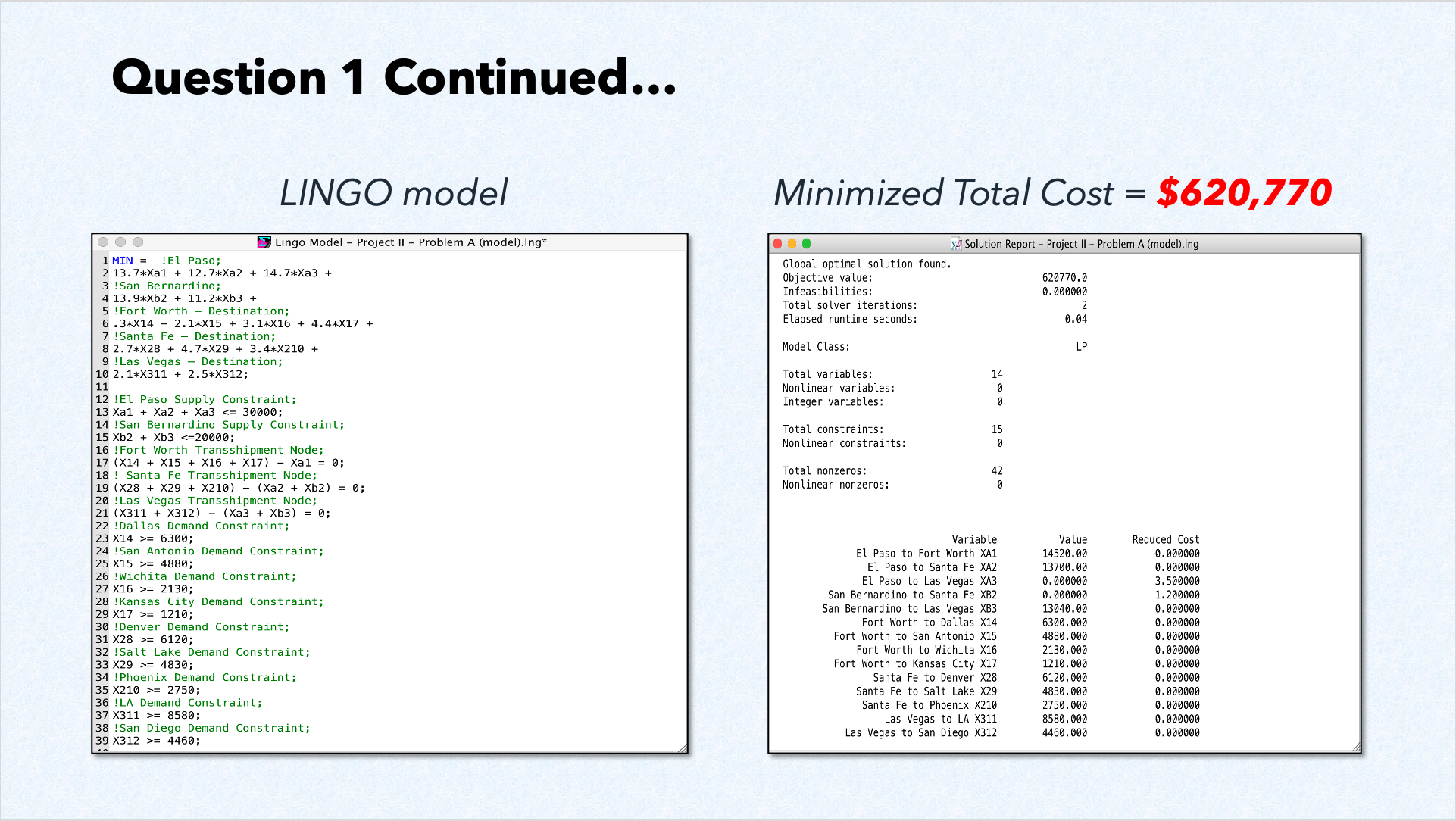

The LINGO model and solution report are included in Figure

2 below:

Figure 2. Optimal solution with current constraints

The optimal solution projects that total transportation costs for the next quarter, given the

current constraints, will amount to $620,770. The El Paso plant is slated to ship 14,520 units

to the Fort Worth Distribution Center and 13,700 units to the Santa Fe Distribution Center. The

San Bernardino plant, however, is expected to ship only 13,840 of its 20,000-unit capacity to

Las Vegas, with no shipments to Santa Fe. At the Fort Worth Distribution Center, 6,300 units

will be distributed to Dallas, 4,880 units to San Antonio, 2,130 units to Wichita, and 1,210

units to Kansas City. Meanwhile, the Santa Fe Distribution Center will dispatch 6,120 units to

Denver, 4,830 units to Salt Lake City, and 2,750 units to Phoenix. Lastly, the Las Vegas

Distribution Center will distribute 8,580 units to Los Angeles and 4,460 units to San Diego.

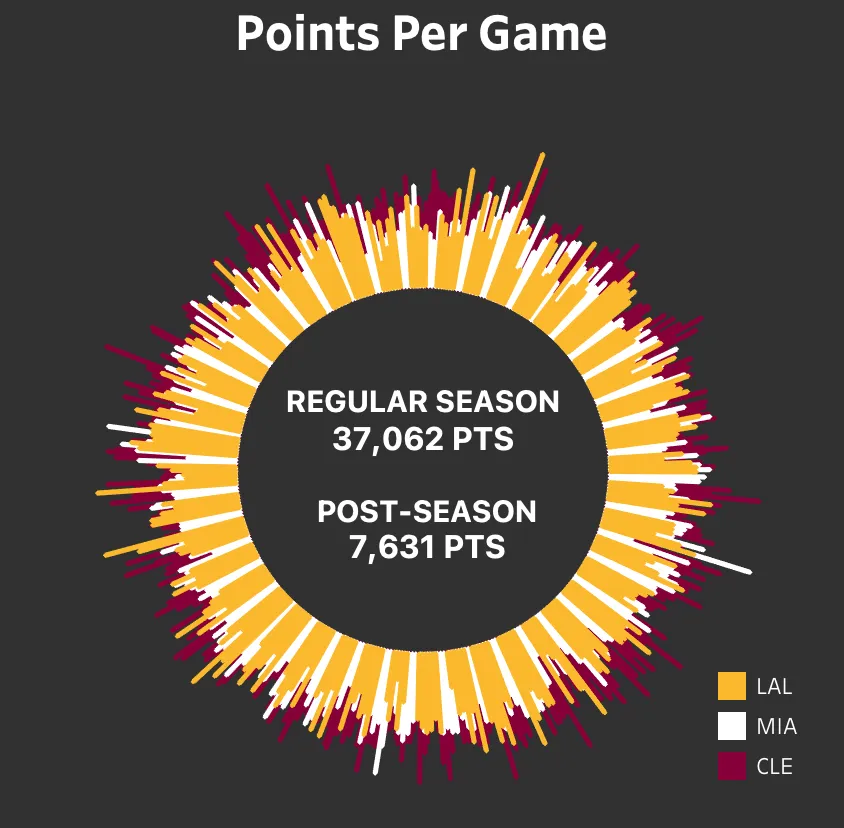

Solution 2

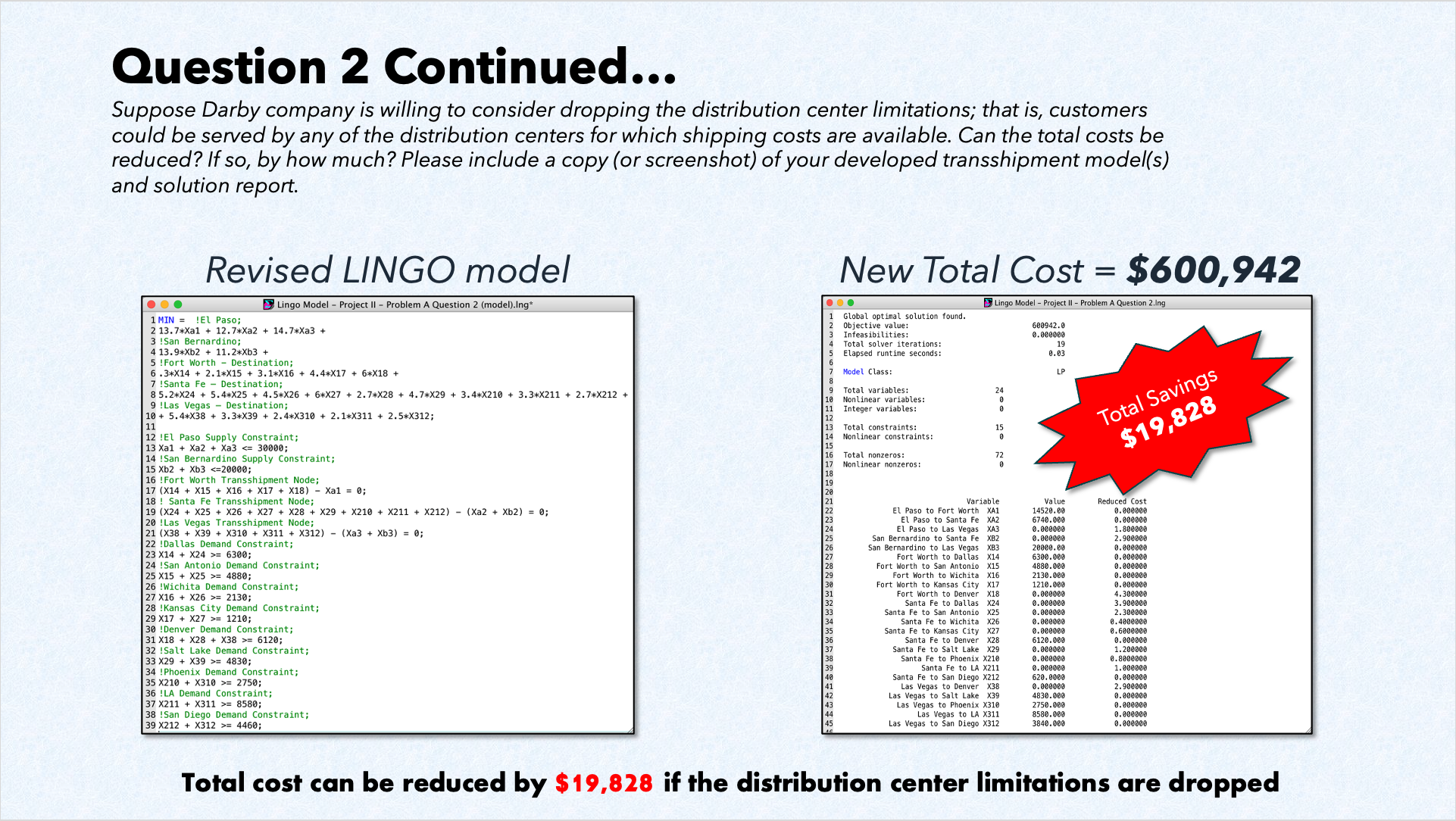

To determine if costs can be reduced if the company is willing to consider dropping the

distribution center limitations, I present an updated graphic representation of the distribution

network along with a modified linear program below in Figure

3 and Figure 4.

Figure 3. Modified distribution network diagram

The green arrows highlight new potential distribution routes. Fort Worth can now ship to

customers in Denver, while Santa Fe can extend its reach to customers in Dallas, San Antonio,

Wichita, Kansas City, Los Angeles, and San Diego. Additionally, Las Vegas can now serve

customers in Denver, Salt Lake City, and Phoenix. The supply and demand levels remain unchanged,

as do the restrictions on the origin nodes.

Figure 4. Optimal solution without distribution

center limitations

If Darby Company were to lift the distribution center restrictions, it could save a total of

$19,828 in shipping costs. By adjusting the constraints, some of the demand could be shifted

from the El Paso production plant to the San Bernardino plant, allowing it to ship its full

capacity (20,000 units) to Las Vegas. Since the transportation costs per unit are lower from Las

Vegas to Salt Lake City ($3.30) and from Las Vegas to Phoenix ($2.40) compared to shipping from

Santa Fe to Salt Lake City ($4.70) and from Santa Fe to Phoenix ($3.40), the company would

benefit from dropping these restrictions and utilizing the more cost-effective distribution

routes.

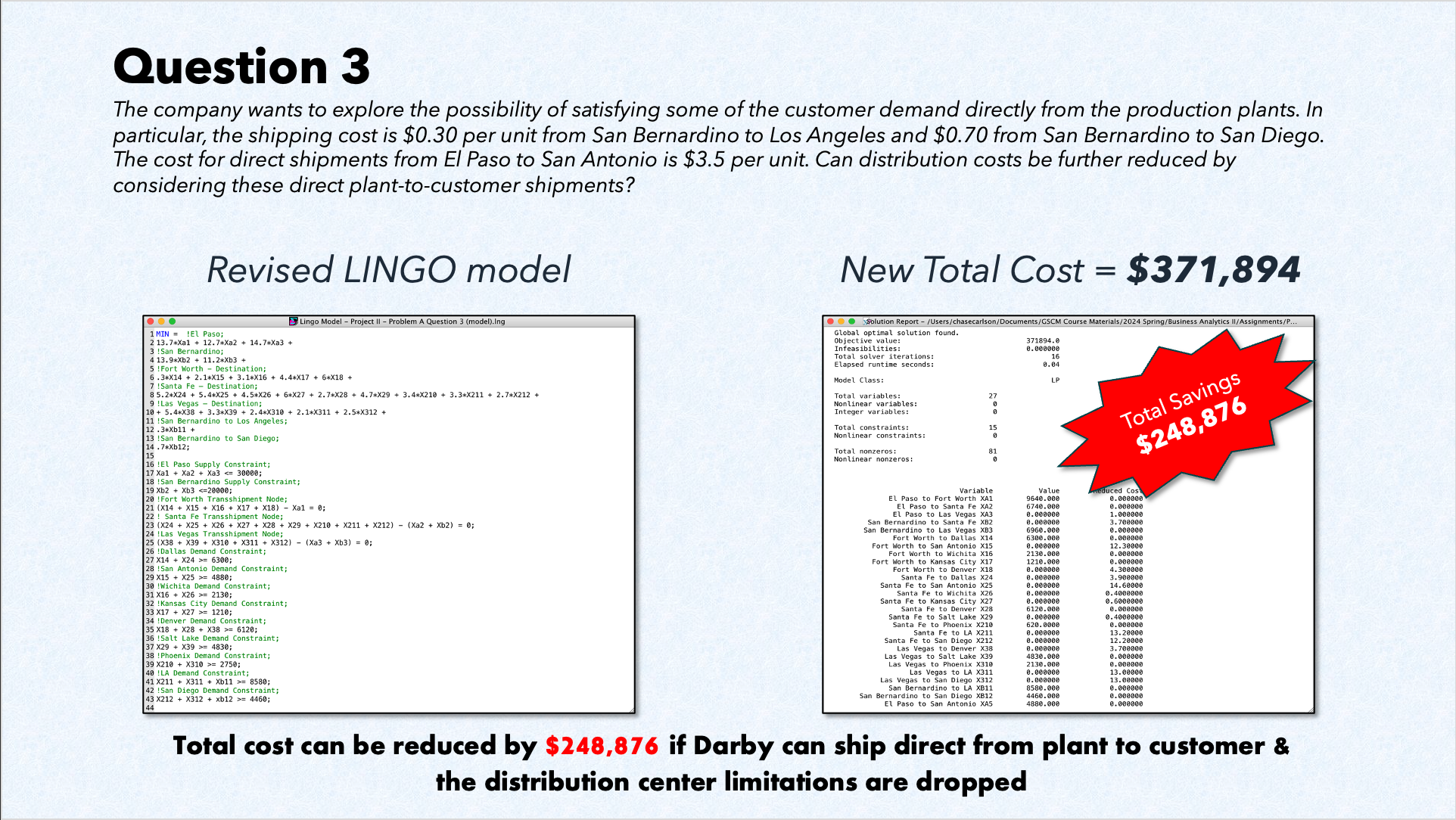

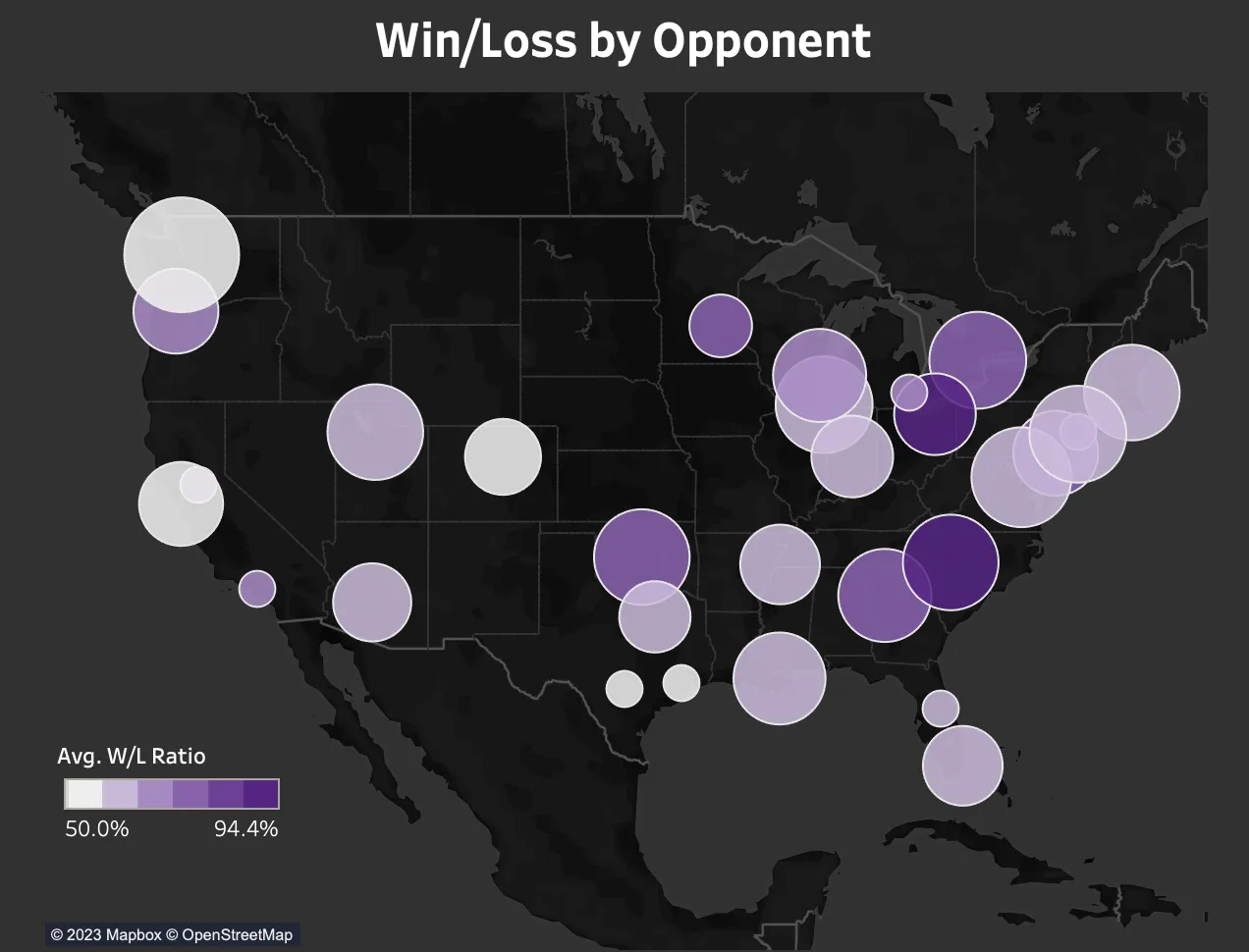

Solution 3

Allowing direct shipments from El Paso to San Antonio, and from San Bernardino to LA and San

Diego add three new arcs to the network model. We add

XA5,

XB11, &

XB12

to the objective function. Additionally, we adjust the demand constraints for San Antonio, LA,

and San Diego to account for the direct shipments from the production plants. The results are

shown below in Figure 5.

Figure 5. Optimal solution with direct-to-customer

shipments

The value of

XA5 = 4,880 indicates

that 4,880 units are being shipped directly from El Paso to San Antonio. Similarly,

XB11 = 8,580 indicates

that 8,580 units are shipped directly from San Bernardino to LA, while

XB12 = 4,460 shows

that 4,460 units are shipped directly from San Bernardino to San Diego. This solution report

highlights a $248,876 reduction in the total cost by implementing these direct-to-customer

shipping routes, translating to a 40% savings compared to the previous supply chain model. Based

on this analysis, it is recommended that Darby Company adopts direct-to-customer shipping from

its production plants and removes the existing limitations on shipping from distribution

centers.